Indigenous Western Lead Loan System

Indigenous American experts seeking get, make, otherwise raise a property found on government trust house can use the fresh new Indigenous Western Head Financing System (NADL). Anyway, Tribes are thought Sovereign Regions. The new NADL assists complete the mortgage credit requirement for Native American experts as well as their partners which seek to reside for the government faith places.

The key benefits of the latest NADL are basically the just like the newest almost every other loan programs, toward a lot more brighten from a guaranteed low-focus, 30-season repaired financial. On the other hand, brand new Tribal government one to statutes the place you must reside need certainly to enjoys an agreement on the quik payday loan government describing how the program are working on the the lands.

Other Virtual assistant Mortgage Solutions

When purchasing or refinancing a property with a great Va financing, you will find most Va software that can be used together for the financial. They must be finalized in addition along with your Va financing. Alternatives were:

- Energy-Successful Mortgage (EEM): Safeguards the expense of to make times-productive advancements to your house

- Alteration and you may Fix Mortgage: Make sure a loan to own alteration and repair from an aging house

- Construction Mortgage: Make a different sort of household on the possessions you currently individual otherwise is to find with financing

- Farm Residence Mortgage: Pick, create, transform, or improve a farm house

Perhaps you have realized, new Va spent some time working tough to provide former and you can productive army professionals to the possible opportunity to flourish when you look at the homeownership, although he has less than perfect credit.

Suggestions for In search of a Va Mortgage

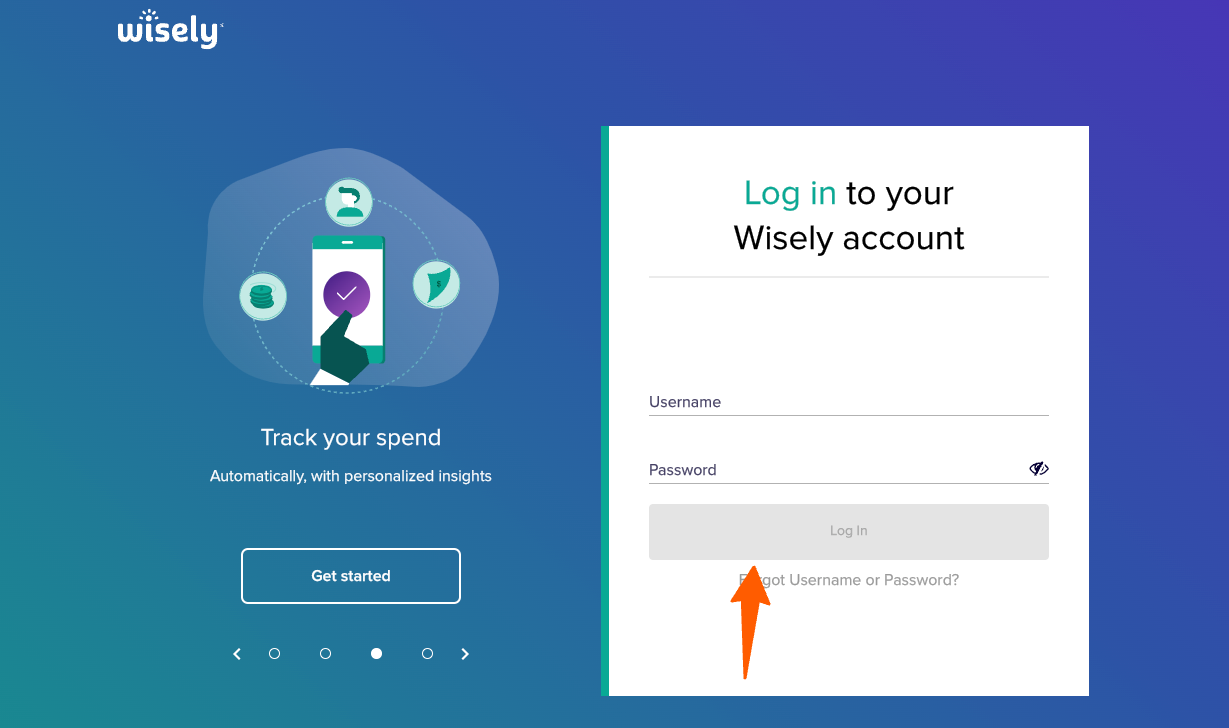

If you’ve decided a great Virtual assistant mortgage is the better option for you, and you may you gotten the Certification out-of Qualifications, there are many different high lenders you might run. Why don’t we discuss getting an effective Va financial that have worst credit.

Although many Va funds will have comparable certificates and software requirements, they are certainly not most of the created equivalent. On the other hand, lenders feel the ability to result in the actual terms of brand new mortgage so you’re able to best benefit the place.

- See your financial reputation. Your credit score, money, and you will financial obligation-to-earnings proportion can also be notably change the terms of your loan.

- Take note of the fees. You can easily usually found a great Virtual assistant capital percentage, however, other can cost you may differ away from financial to lender.

- Glance at the Apr (APR). Really loan providers direct on the rate of interest, but the Annual percentage rate will additionally are almost every other charges energized from the bank.

- Look around. Inquire having numerous Virtual assistant mortgage brokers and you may review its certification criteria and you can introductory interest levels and you can charge.

- Pick a loan provider your believe. You will likely work on the financial institution for quite some time. Given that Va possess you recognized, you will need to manage a home loan company that provides the brand new services need, such as for example on the web payments.

With regards to looking a loan provider your faith, there are some kinds you may mention. For every single has its advantages and disadvantages.

Direct Lenders

An immediate bank is a financial institution such as a financial, borrowing from the bank union, or on line bank one develop mortgages making use of their very own currency. Loan maintenance, handling, and you can underwriting take place in-home. Playing with an immediate financial is specially of good use if you have good pre-current relationships. Your repair is easier, and you’ll become more browsing become approved.

Lenders

Should you want to comparison shop and have now a few even more dollars to blow into the a fee percentage, you could work at a mortgage broker. Mortgage brokers don’t possess connections to just one financial or financial facilities. Commonly, it works that have a number of loan providers to pick the finest device. A brokerage will help you to see the loan words and you can suggest with loan providers for you. not, you are going to exchange a lower rates otherwise most useful term having good fee.